BLF global equities mandate adds to overseas focus

The $200 billion pension fund is balancing exposure to the surging Taiwan stock market with further steps towards ESG integration.

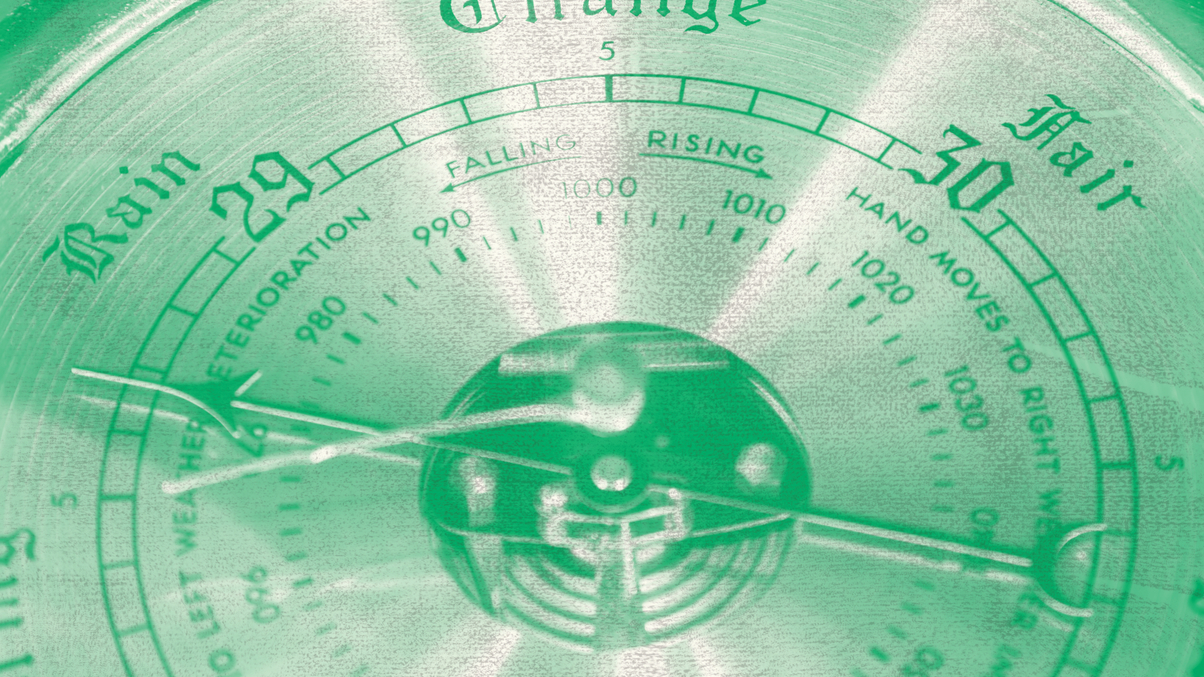

The announcement by Taiwan’s Bureau of Labor Funds (BLF) of a tender for a $2.3 billion global climate change equities mandate that tracks benchmarks related to the Paris climate accord is another step to fulfilling its offshore assets allocation target and focus on equities.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.