Expect Korea wave into alternatives

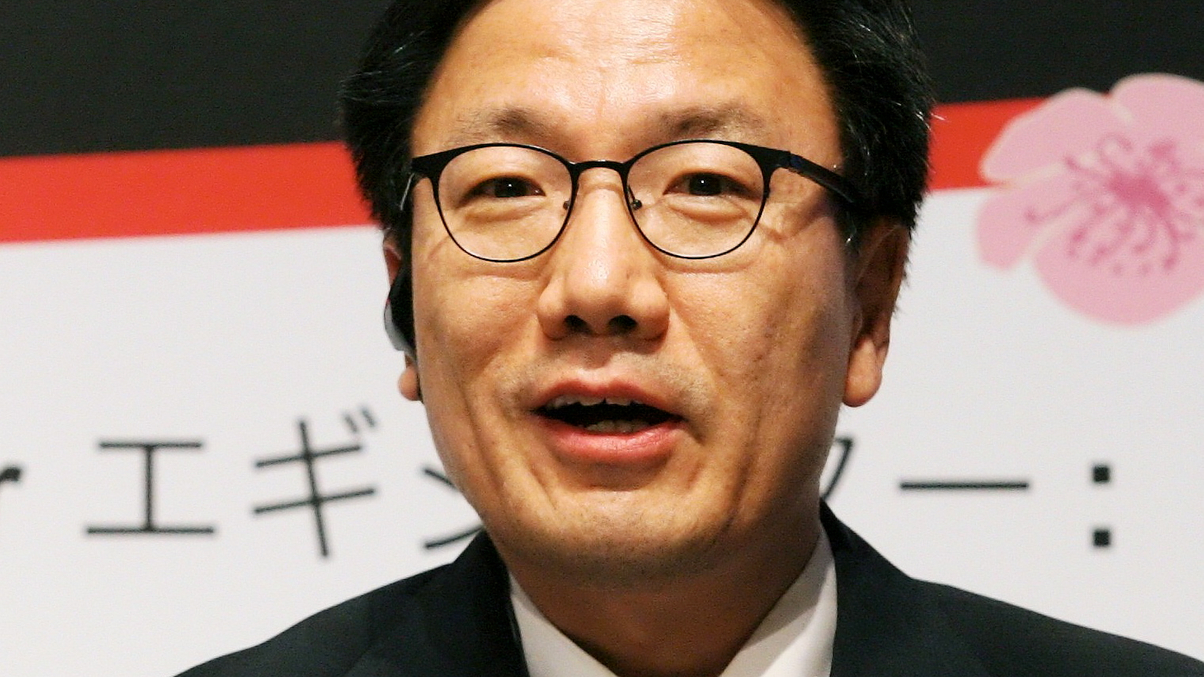

The former head of real assets at Korea Post says Korean institutional investors are set to pour money into global alternative investments.

Institutional investors from South Korea are going to become major allocators to global alternative investments, says the former head of real-asset investments at Korea Post.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.