Weekly roundup of people news, Sep 6

Barings hires new HK/China equities head, Loomis Sayles appoints EM head, AMP Capital makes changes, Bosera PM arrested, sell-side moves at Morgan Stanley and JP Morgan.

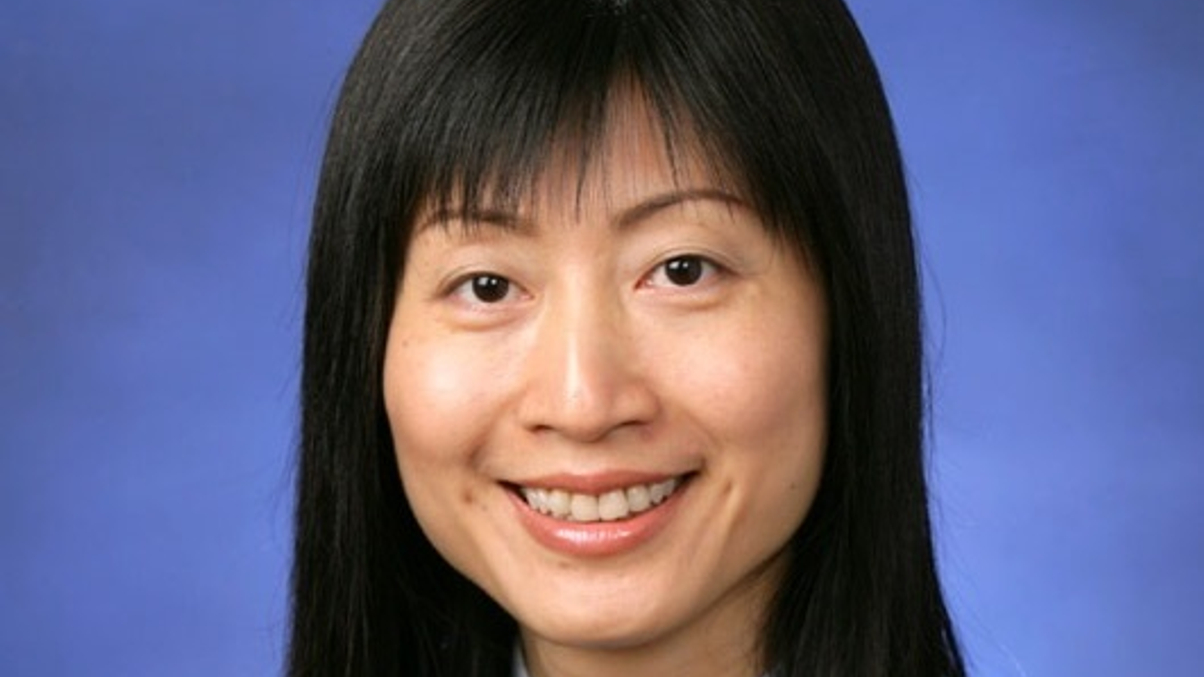

Barings poaches HK/China equities head

UK fund house Baring Asset Management has hired Laura Luo as head of Hong Kong and China equities from Schroder Investment Management.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.