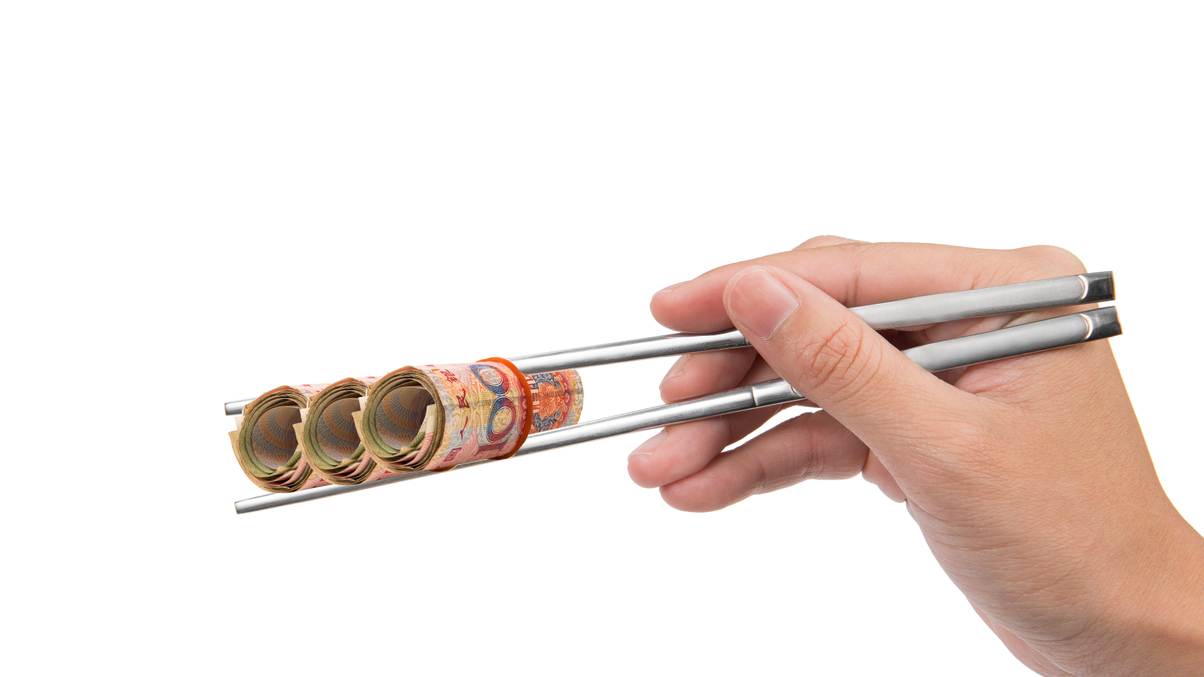

China asset owners ramping up for private equity push

Institutional investors – most notably insurance firms – in China are increasingly looking to step up allocations to private equity, with the encouragement of regulators.

In many respects, private equity in China looks very promising for institutional investors.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.