Why Taiwan’s new fund rules won't prevent “churning”

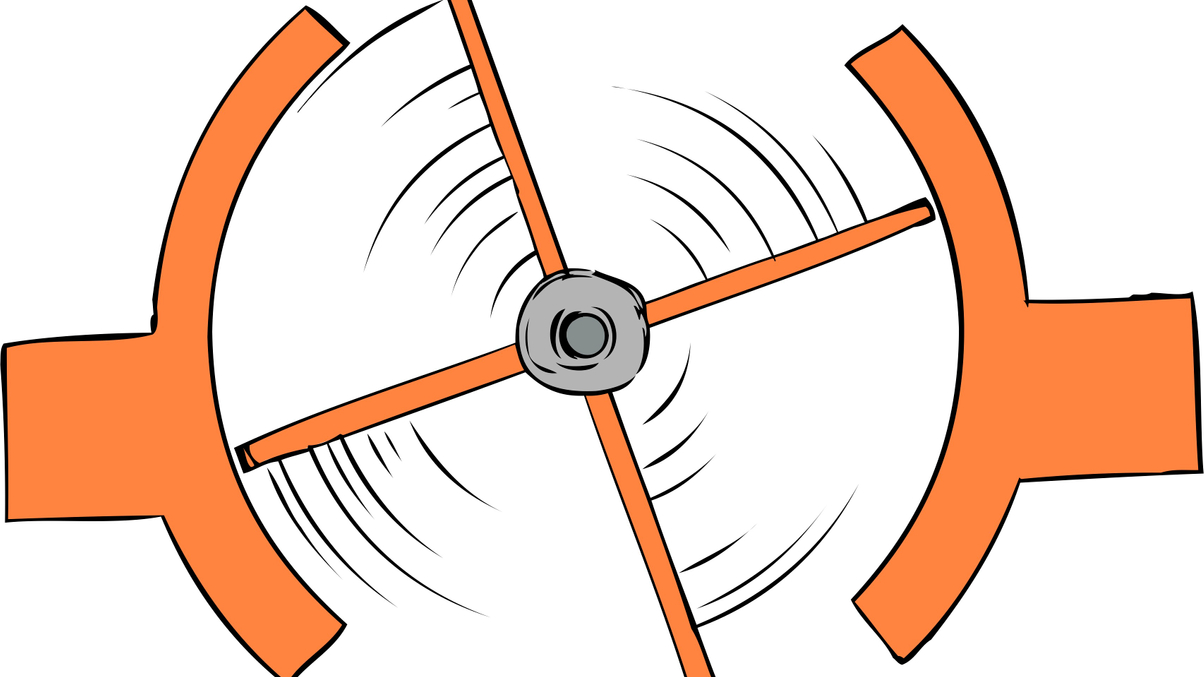

The local regulator is introducing new rules to discourage wealth managers from constantly shifting investor assets into new funds. But some believe the practice will continue.

New rules are being introduced to stop Taiwanese banks from constantly shifting the assets of their investors into new funds just so they can earn additional fees.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.