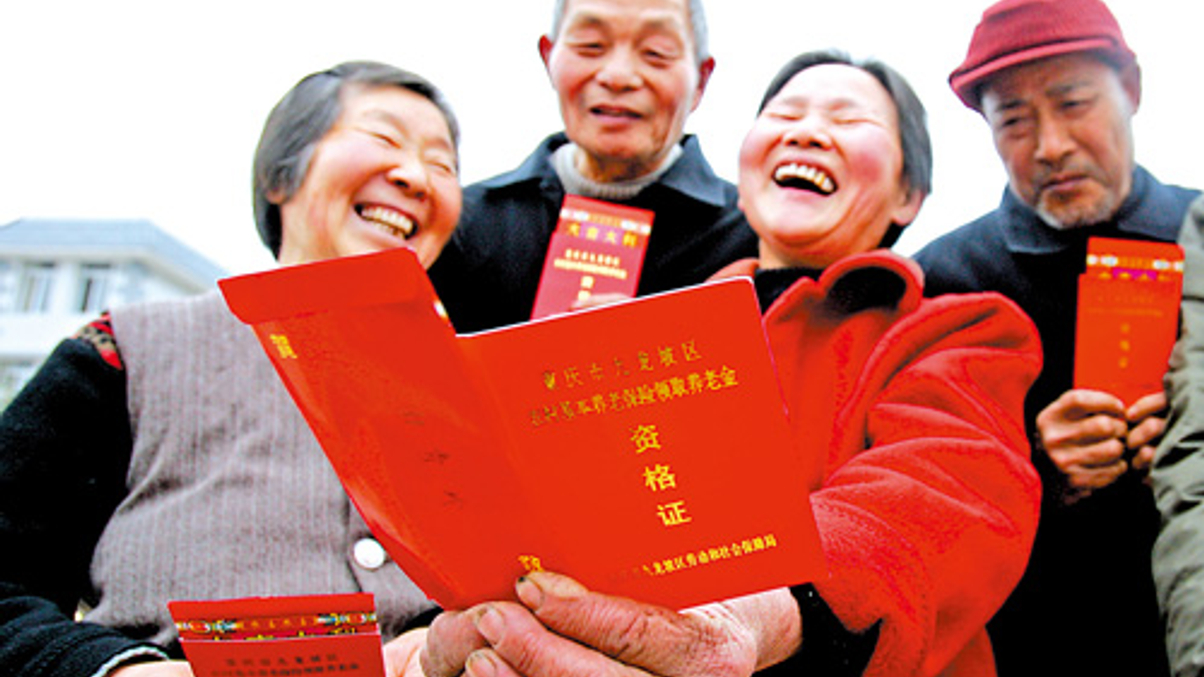

New reforms could invigorate China's pension industry

The extension of a tax-deferred pension insurance scheme in some Chinese provinces, together with new target funds for third pillar pensions, could bolster its pension market.

China’s latest efforts to reform its pension market could help the country improve its rate of retirement savings, but it needs to pursue even more changes if it is to avoid a massive pension deficit, say industry experts.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.