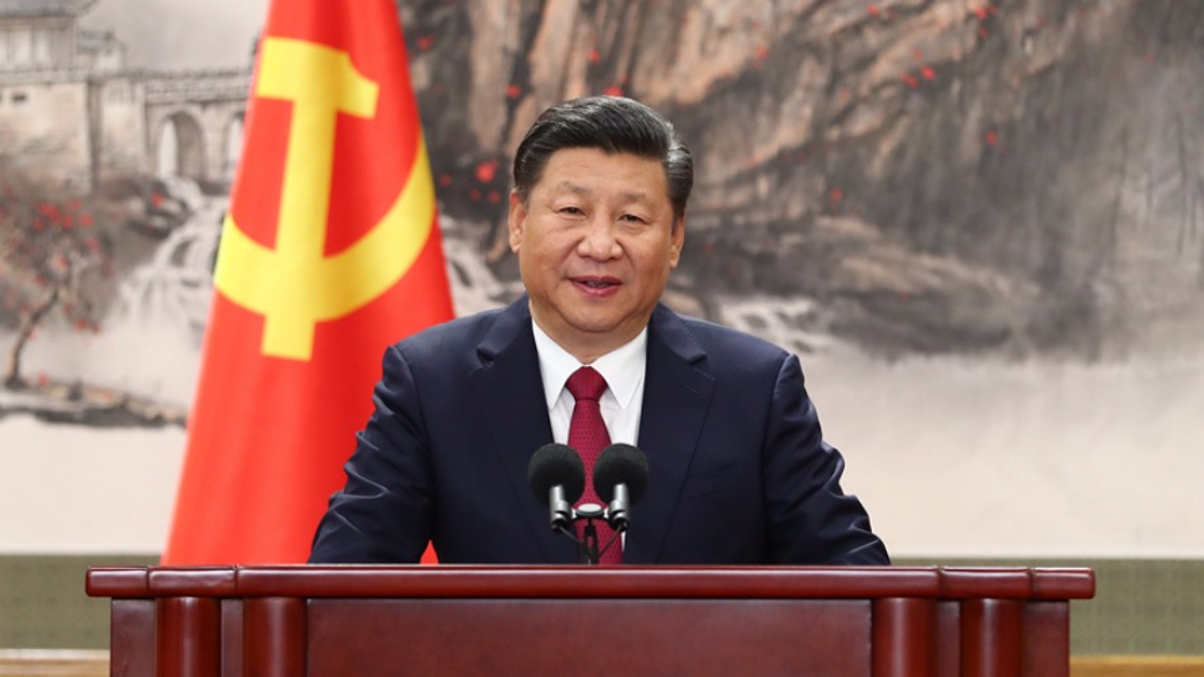

China’s leadership reshuffle reassures foreign investors

The unveiling of China’s new leaders helped to resolve lingering uncertainties over the country's political future, and raised the likelihood that financial reforms will continue.

New names in China’s leadership and President Xi Jinping’s tightened grip of power raises the likelihood that that the country will press ahead with economic reforms and seek to instill more order into the financial market.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.