Opinion widely split after Jackson Hole “non event”

The burning question is: will the US Federal Reserve start reducing its balance sheet next week? Investment experts are divided.

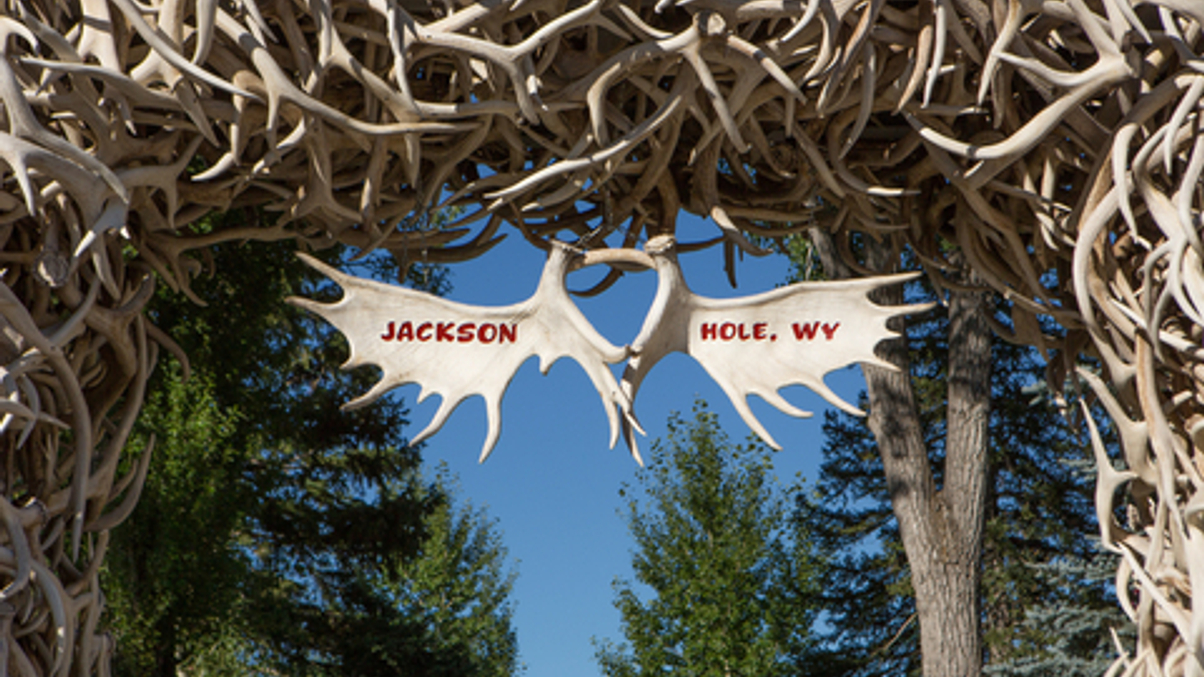

With investors eagerly awaiting signals on US balance-sheet unwinding and tapering of European bond-buying, the meeting of central bankers in Jackson Hole, Wyoming was seemingly a “non event”. It has merely served to prolong market uncertainty, judging by the variance in opinion among market experts on what will happen next.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.