Newsmakers in June: Top 20 pension executives, KIC, Temasek, AIMCo

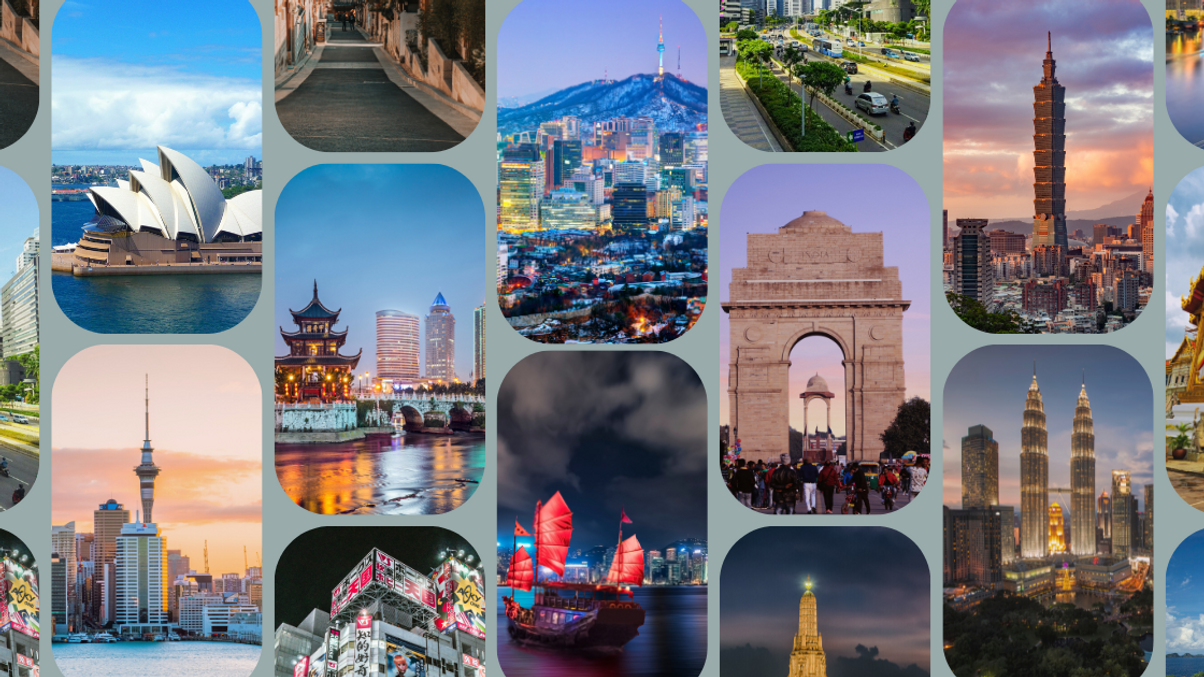

June marked the reveal of AsianInvestor's Top 20 noteworthy pension executives in the region. Among other coverage of asset owners, a Bollywood star who launched a family office stood out, as did insights from KIC’s CIO who opened the Institutional Investment Forum Korea in Seoul.

In June, AsianInvestor highlighted the individuals who stand out for helping drive the Asia Pacific pension industry forward by improving the investment processes, operations and accessibility of pension funds.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.