CS deal to boost iShares’ Asia insto, private bank biz

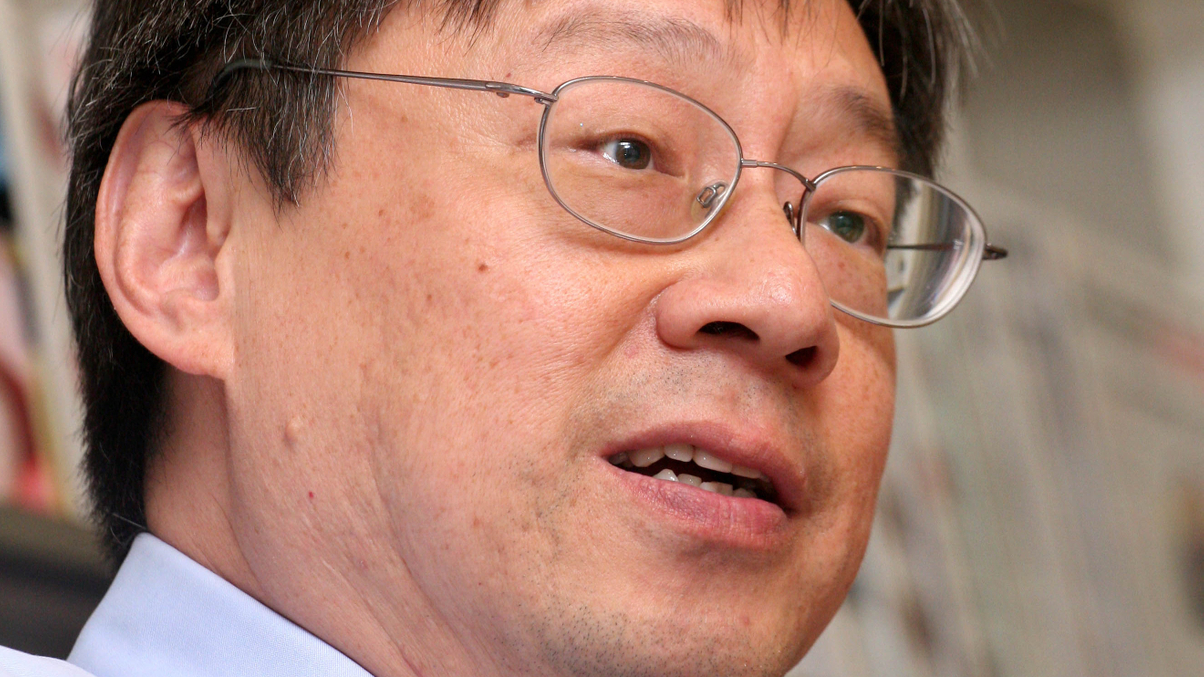

The question remains, however, as to whether Joseph Ho will stay with BlackRock once it acquires Credit Suisse’s ETF business.

BlackRock’s agreement to buy Credit Suisse’s exchange-traded funds arm may be a Europe-centred deal, but the international nature of the ETF industry gives the move global implications.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.