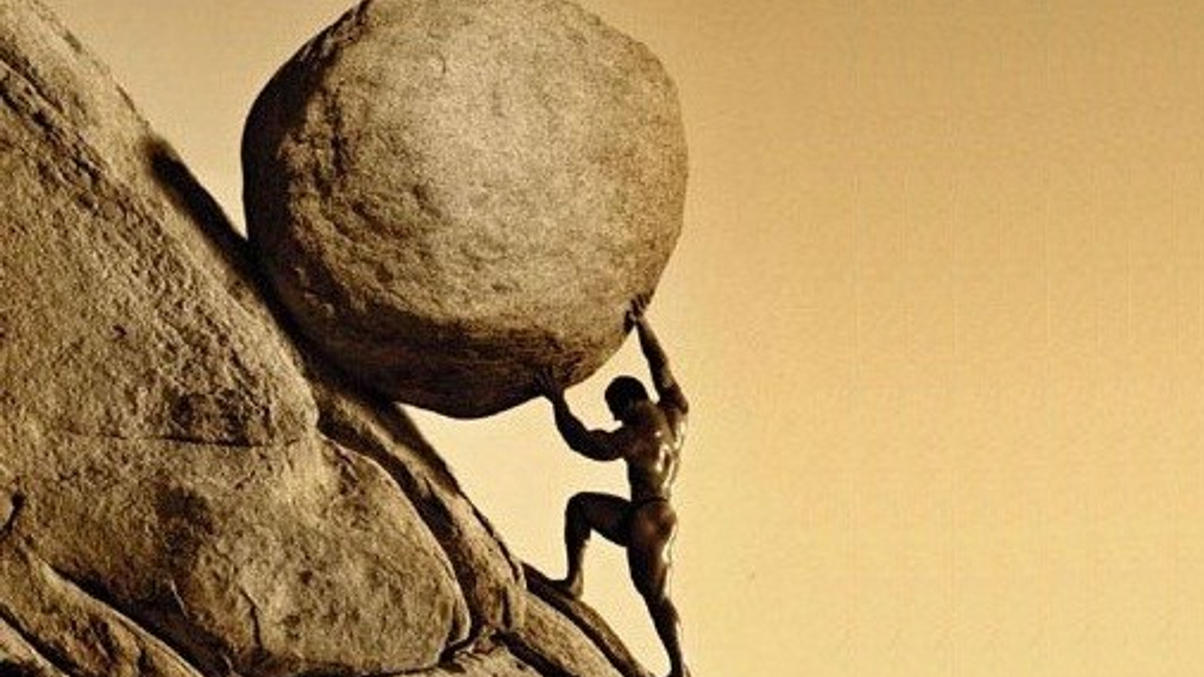

Chinese hedge funds face uphill struggle to expand offshore

In the first of two articles on Chinese fund managers moving offshore, we look at the challenges they face in building an overseas business. Estimates suggest only one in five survive.

Chinese hedge fund managers have been lining up to establish operations in Hong Kong and to a lesser extent Singapore, but they face an uphill struggle if they are to build a sustainable business. Some put the rate of survival of mainland hedge funds past three years at just 20%.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.