BVI eyes rich Chinese, SE Asian families

The British Virgin Islands' new office in Hong Kong will field a rising number of enquiries about BVI trust structures. But it may not find it easy to take funds business from the Cayman Islands.

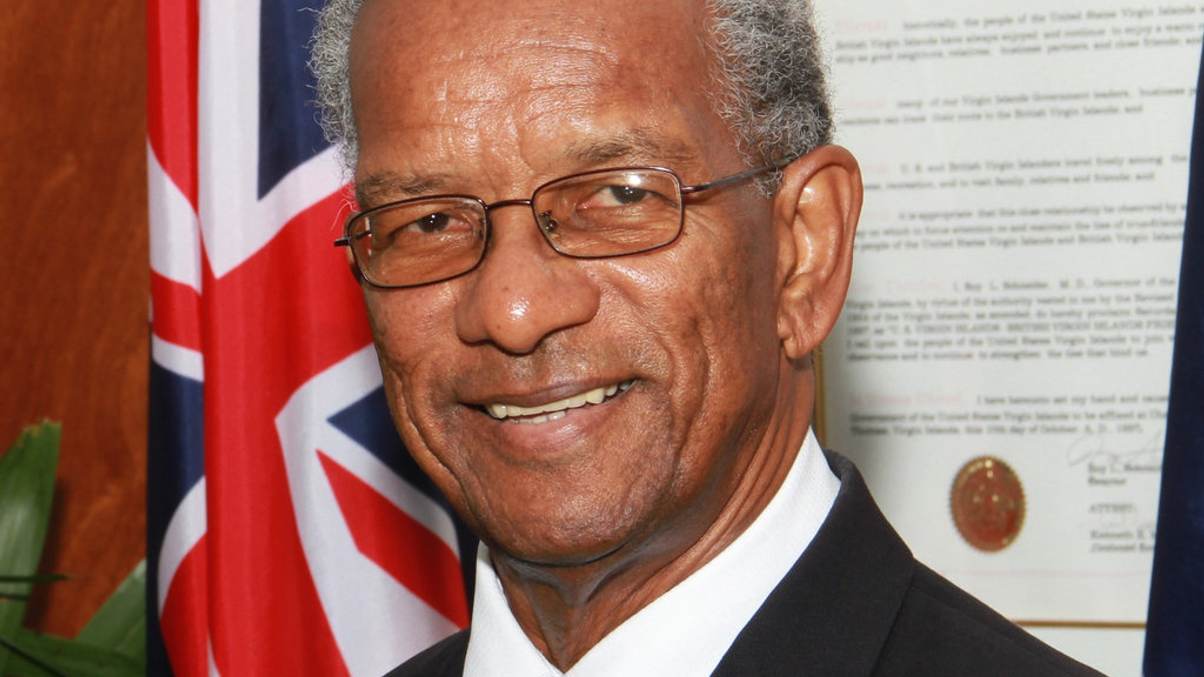

Interest is rising among rich Chinese and Southeast Asians in setting up trusts to pass on their wealth to the next generation, says Orlando Smith, premier of the British Virgin Islands – a trend he expects to benefit the Caribbean territory.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.