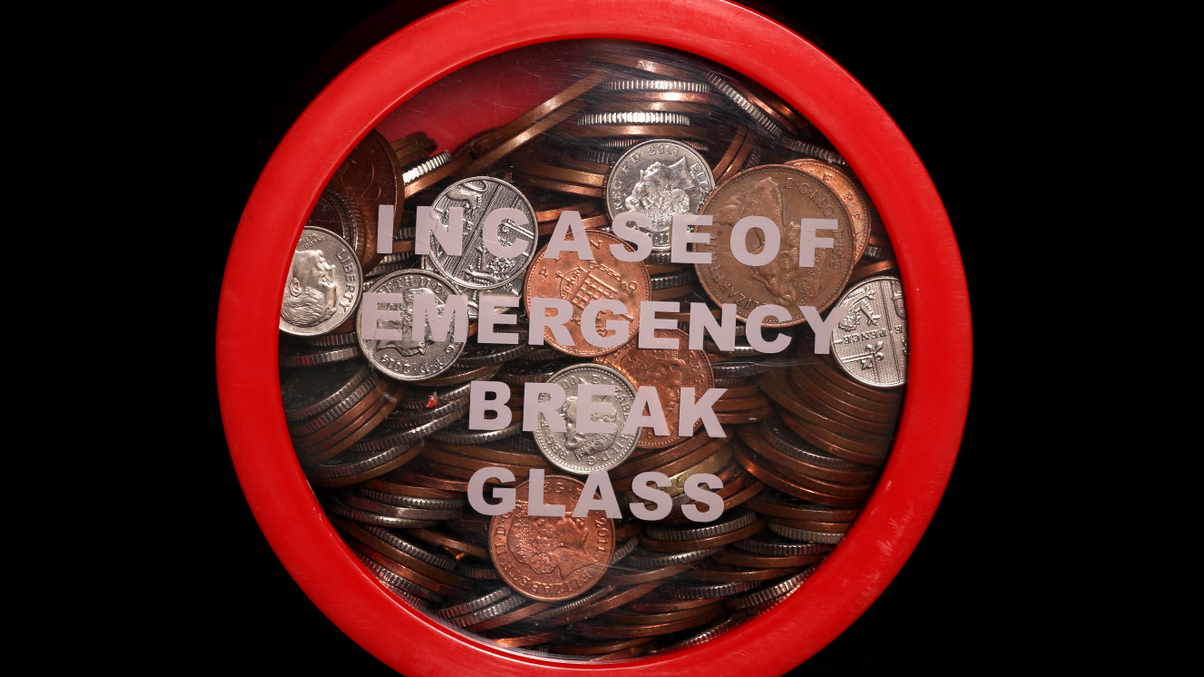

Asia SWFs to resist pressure for emergency funding

Regional governments are weighing all funding options to offset falling economies. But few look likely to draw down on sovereign fund assets – for now.

Governments around Asia Pacific are agonising over how best to cover the cost of the economic fallout from the ongoing Covid-19 pandemic. One option several governments in the region have is to tap the assets of their sovereign investment funds.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.