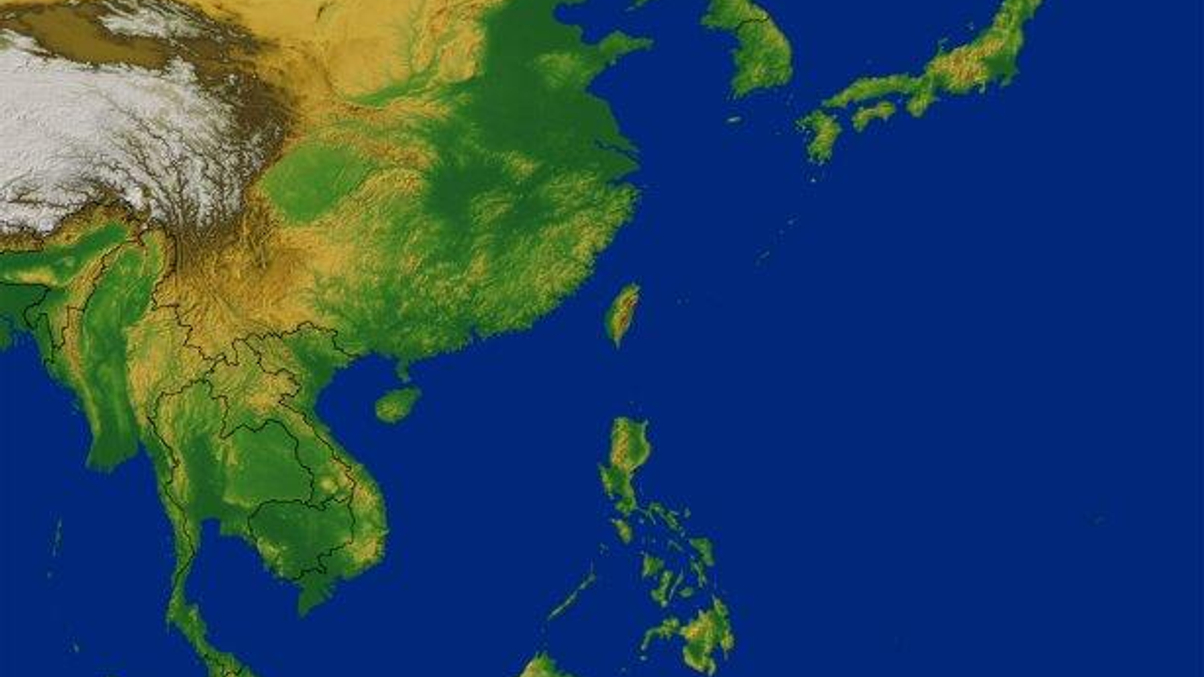

Mutual funds face decline in SE Asia: Cerulli

As Southeast Asians accumulate wealth, they will likely invest more in non-traditional assets, including real estate and insurance products. That looks set to deplete industry AUM.

As Southeast Asians become more affluent, they will likely shift their focus from mutual funds to investment opportunities offering higher returns, according to research house Cerulli Associates.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.