Manulife AM names new Asia head of equities

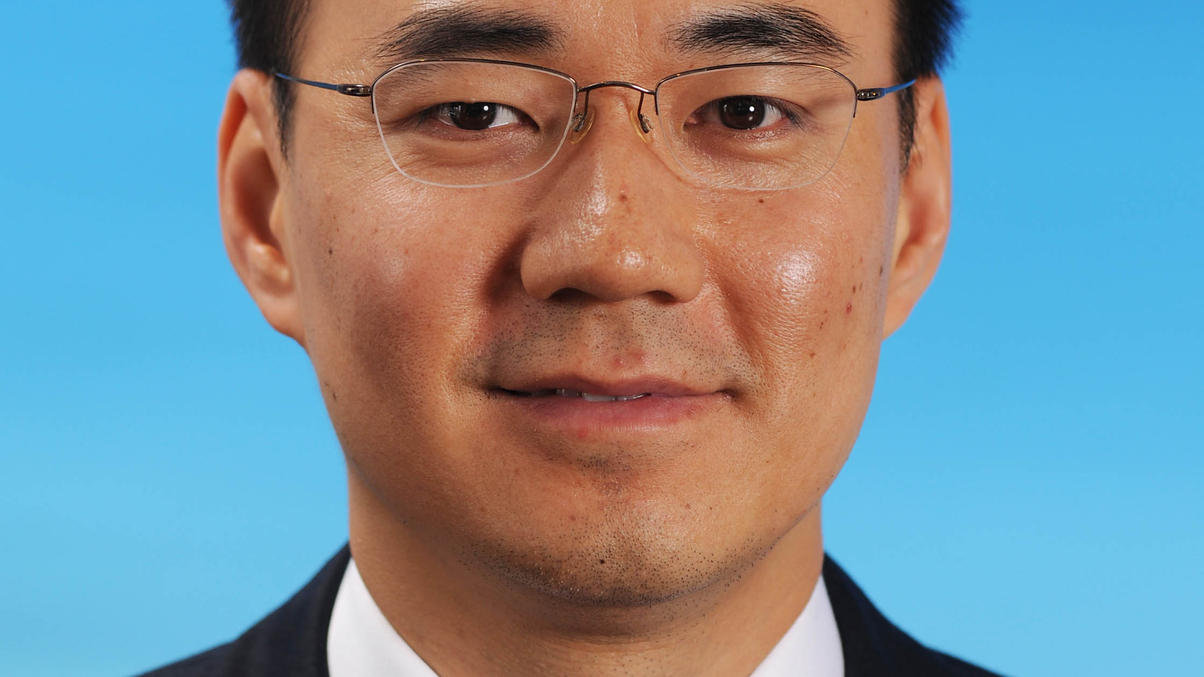

The asset management arm of Canada-based Manulife Financial hires Ronald Chan from Pacific Eagle to replace Tahnoon Pasha.

Manulife Asset Management has appointed Ronald Chan from Pacific Eagle as senior managing director and head of equities for Asia to sharpen its suite of products and drive AUM.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.