Weekly roundup of people news, May 30

Max Wong of Franklin Templeton to join Oaktree; Future Fund taps ESG risk head; Natixis adds in sales; Barclays fills equity gaps in Korea, India; and Deutsche names Vietnam chief.

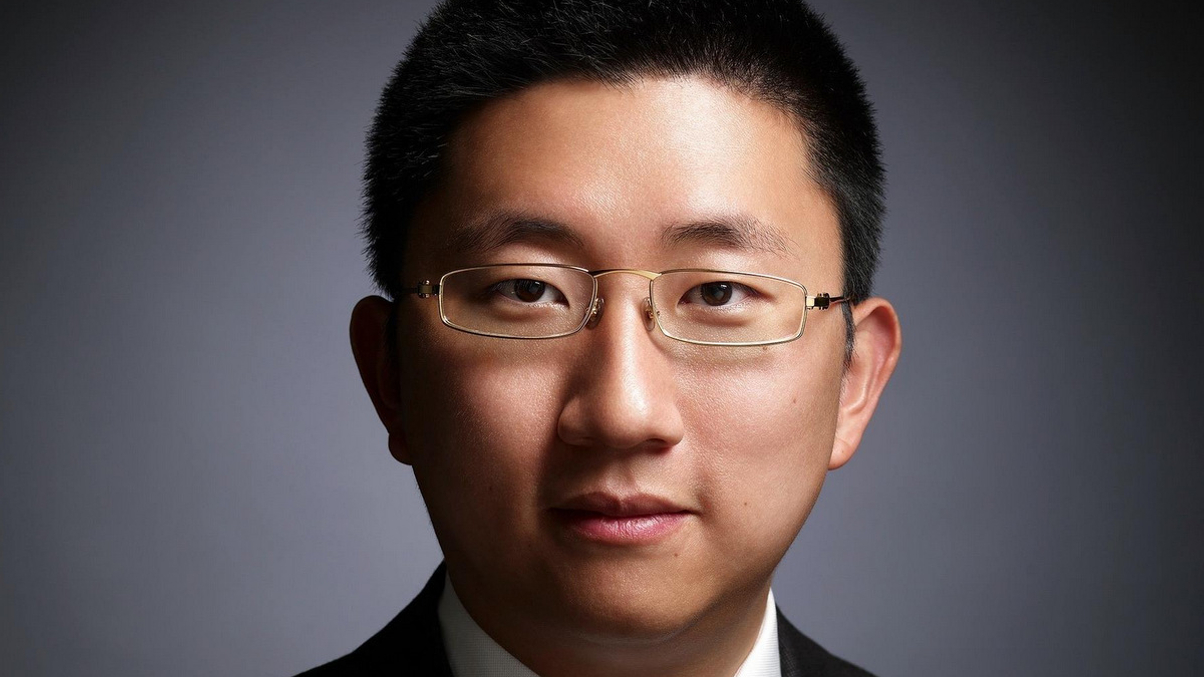

Max Wong joins Oaktree

US fund house Franklin Templeton has lost its head of institutional business for Greater China, Max Wong, to alternatives manager Oaktree Capital Management.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.