UPDATE: DeAWM hires ex-JP Morgan veteran: sources

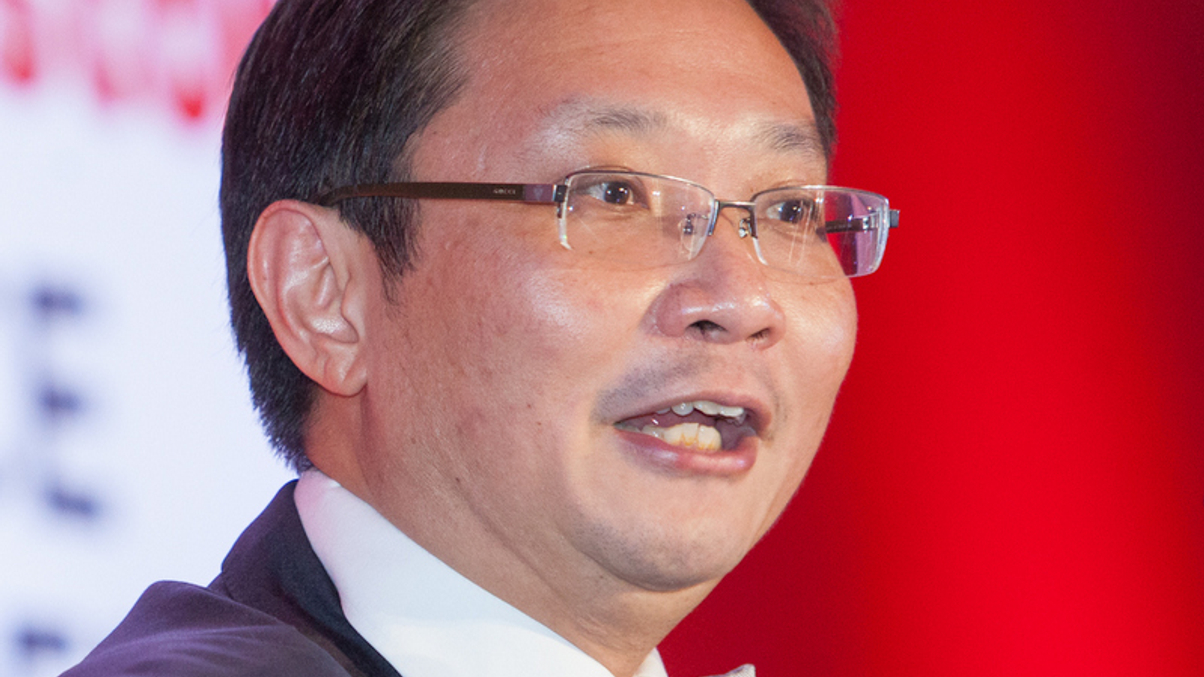

Ken Tam is said to have joined Deutsche Asset & Wealth Management as head of North Asia sales, a role similar to the one he had held at JP Morgan Asset Management.

JP Morgan Asset Management’s former head of North Asia, Ken Tam, has joined Deutsche Asset & Wealth Management as head of North Asia sales, say sources. He is said to be tasked with covering the institutional and retail business and to report to Ravi Raju, DeAWM's Asia-Pacific chief executive.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.