Survey shows investments rebalancing out of emerging markets

According to a survey conducted by AsianInvestor and Clifford Chance, individual investors are becoming more important while flows to developed countries are expected to rise.

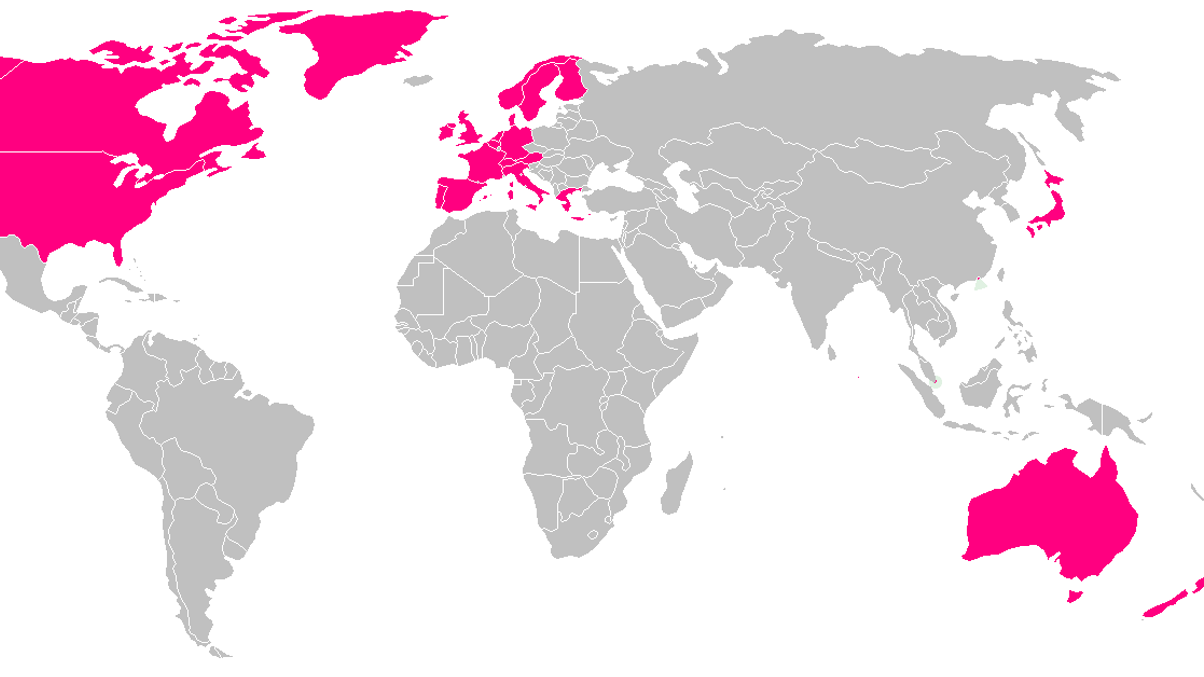

A survey of buy-side market participants shows rising expectations that investment flows in the coming 12 months will increase to developed countries, with lesser flows likely to head to China and other emerging markets.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.