NPS to revisit hedge funds

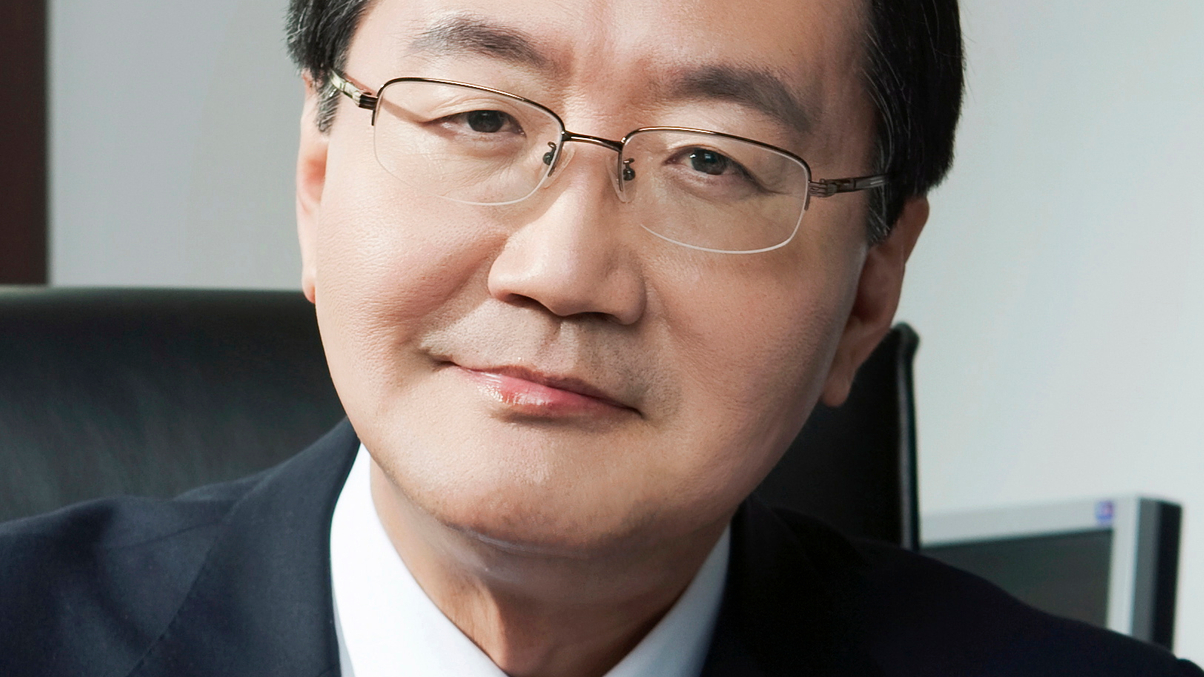

The National Pension Service may begin internal deliberations on whether to ask for legal changes allowing it to invest in hedge funds, says CEO Jun Kwang-woo.

Jun Kwang-woo, CEO of Korea’s $340 billion National Pension Service, says the timing may improve next year to consider putting hedge funds on the agenda.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.