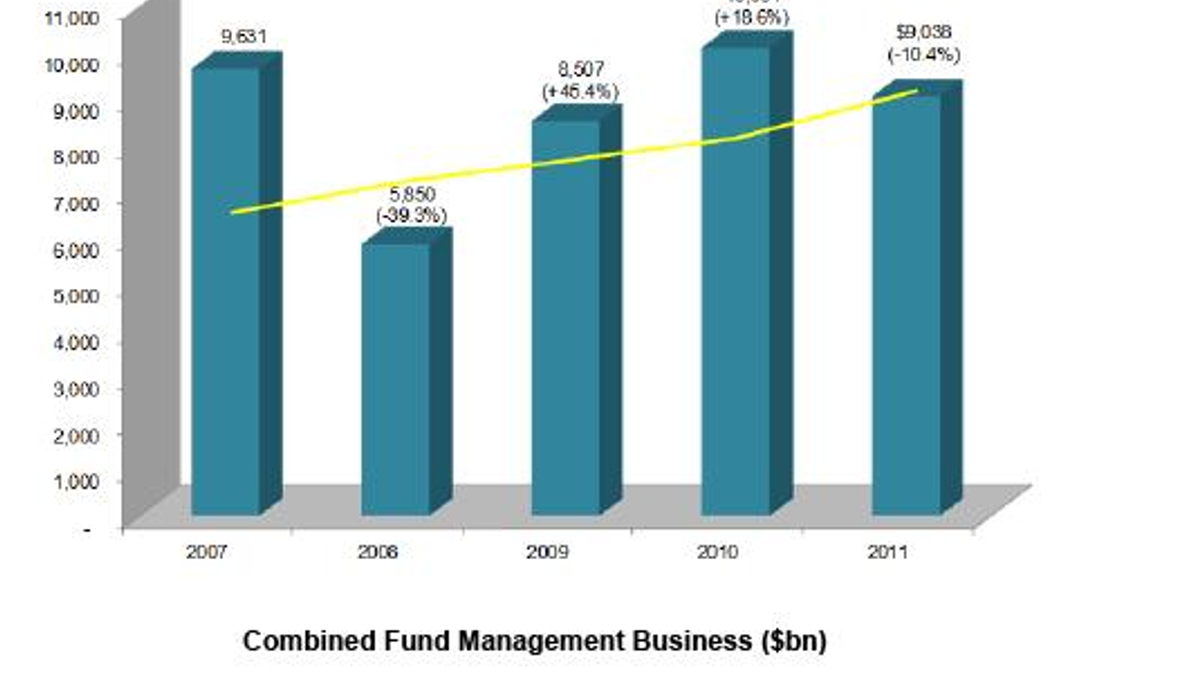

Less money, more players in Hong Kong

New data from the Securities and Futures Commission shows more players in the territory’s funds industry fighting over fewer assets.

Hong Kong may be ground zero for renminbi-denominated products and the springboard for mainland China fund managers, but that privileged status hasn’t boosted the asset-management industry.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.