How India is feasting on Chinese PE leftovers

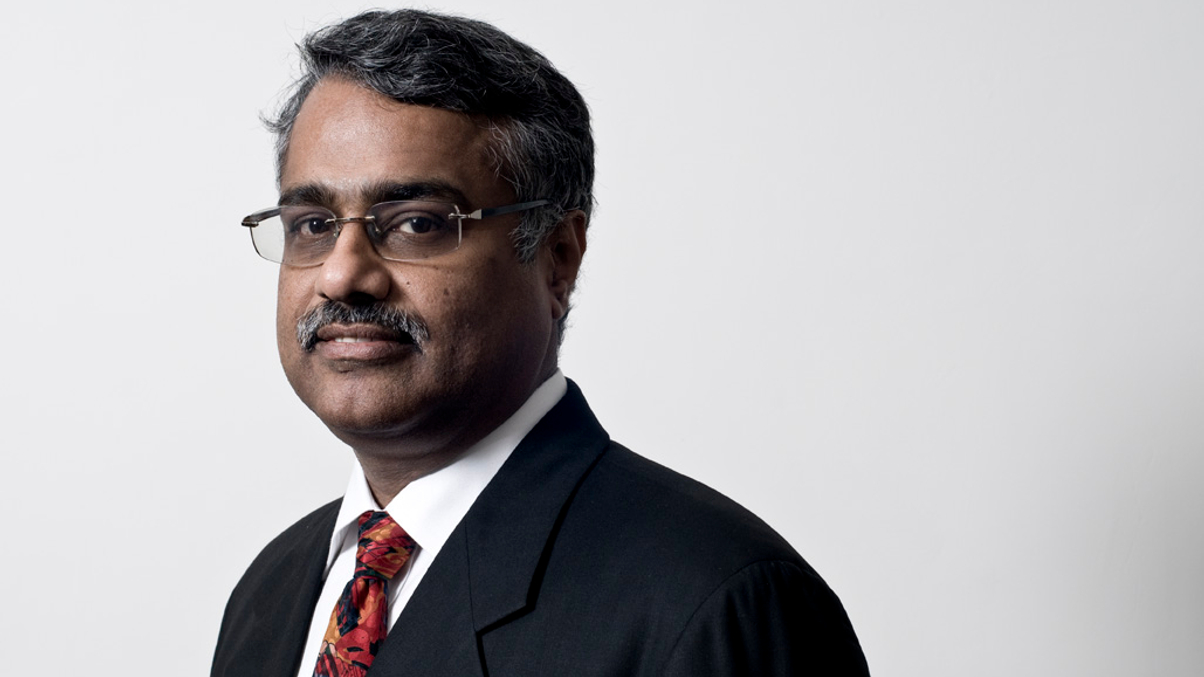

Finding investor capital is hard for Indian private equity. It's time for international investors to stop perceiving the country as so risky, reckons Subbu Subramaniam of MCap.

International investors should evaluate the real risk of investing in India objectively, reckons Subbu Subramaniam, founder of MCap Fund Managers, which manages an India focused growth capital fund.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.