Fullerton trading head backs global oversight of HFTs

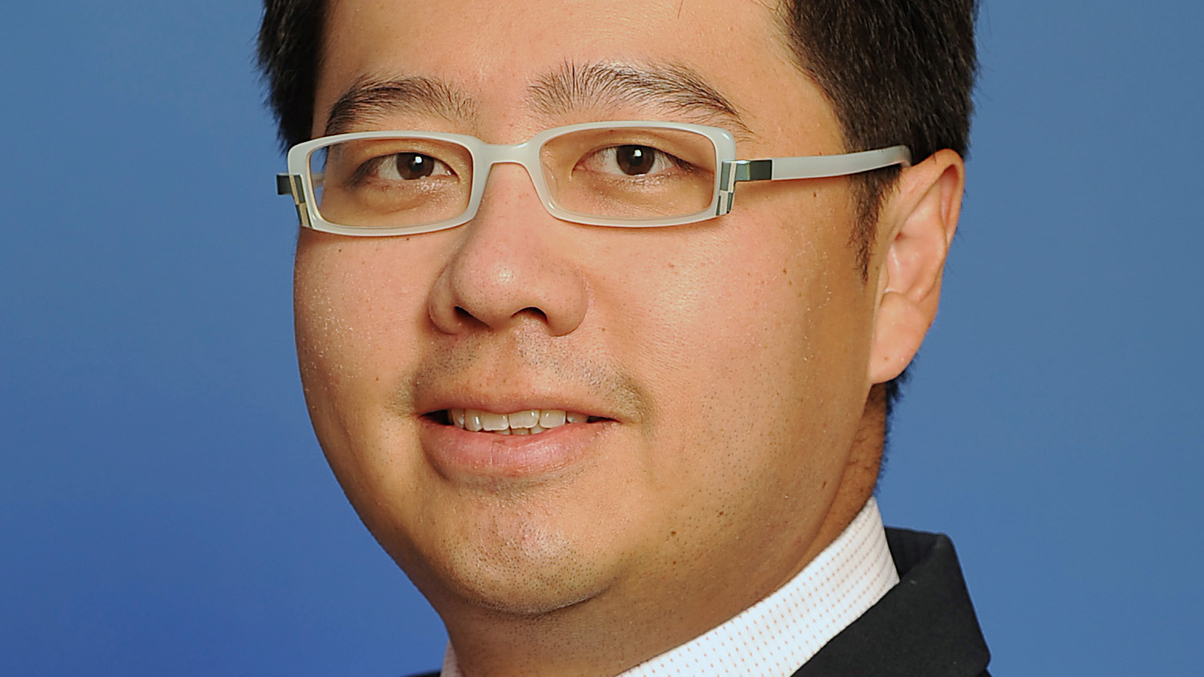

Darren Tay, who runs the dealing desk at the Singaporean fund house, outlines some of his concerns, including market fragmentation and changing market microstructures.

In light of the volatile markets of the past few quarters, Fullerton Fund Management's dealing team has been spending more time looking at behavioural finance and argues that global rules for high-frequency traders are needed.

Sign In to Your Account

Access Exclusive AsianInvestor Content!

Please sign in to your subscription to unlock full access to our premium AI resources.

Free Registration & 7-Day Trial

Register now to enjoy a 7-day free trial—no registration fees required. Click the link to get started.

Note: This free trial is a one-time offer.

¬ Haymarket Media Limited. All rights reserved.