China lifers face ALM challenge from new tax rules

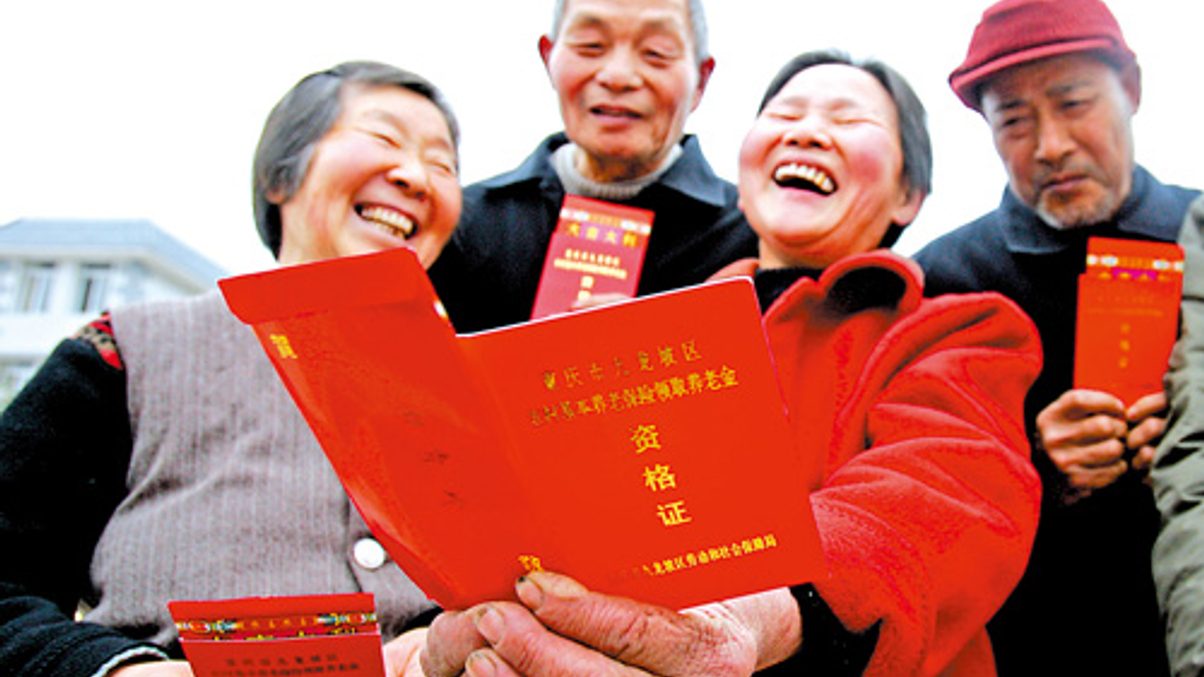

Beijing's new tax-deferral scheme for certain pension products will boost revenues for life insurers but also create longevity and reinvestment risks and affect allocations, say experts.

New Chinese rules introducing tax deferrals on certain pension insurance products are set to boost revenues from domestic life insurers’ annuity business, but will also create greater asset-and-liability management challenges, said industry experts.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.