SFC proposals “may drive” fund launches to Singapore

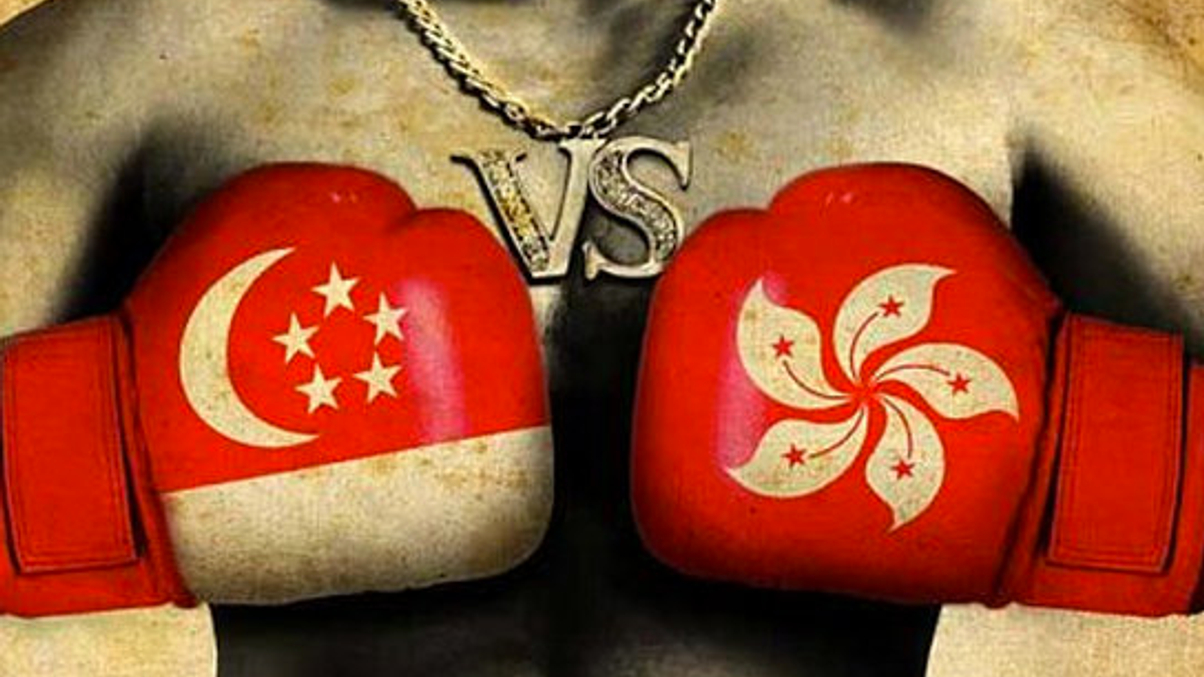

More industry experts are voicing concerns about Hong Kong's planned fund manager conduct rules, saying the city risks losing business to its main rival.

Hong Kong’s markets regulator risks harming the city's competitiveness as an asset management centre with proposed changes to the fund manager code of conduct, argues Philippa Allen, chief executive of Compliance Asia Consulting.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.