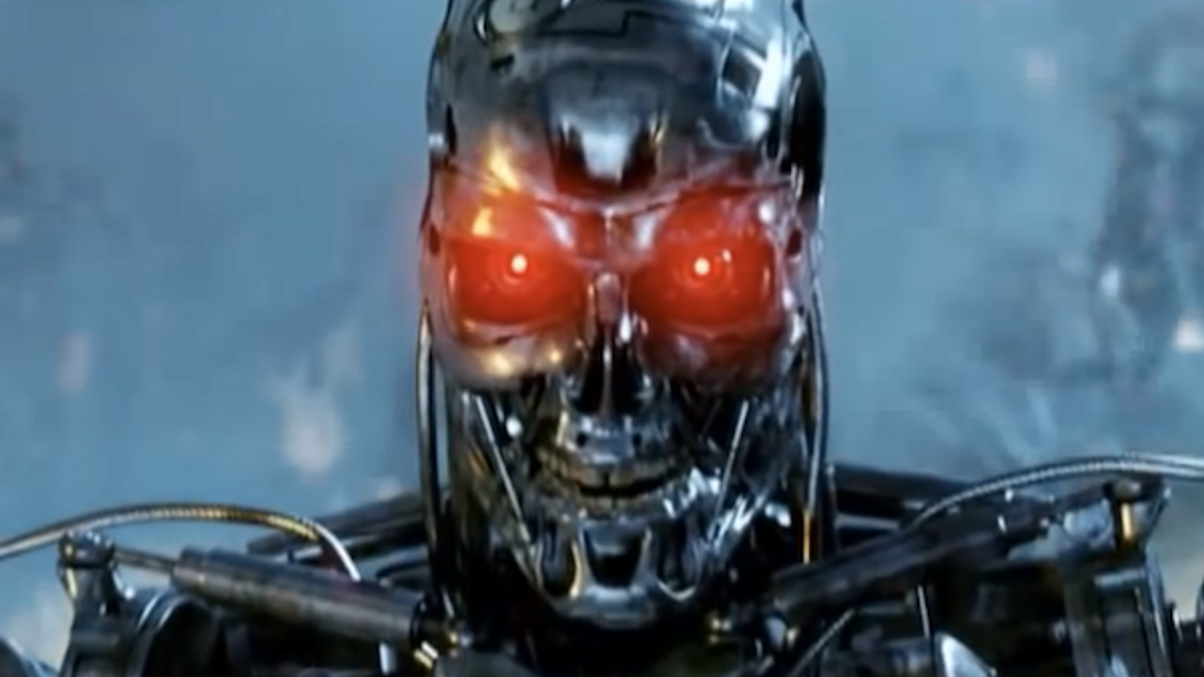

Will technology render many asset management activities obsolete?

We have identified the five most crucial challenges facing the asset management industry. Today we address the fourth issue: the extent to which technology will usurp humans.

The asset management industry in Asia has undergone big changes since AsianInvestor started in 2000. Having served as the title's founding editor and, more recently, as editorial director at Haymarket Financial Media, I’ve enjoyed a front-row seat. As my final contribution for AsianInvestor, I have come up with a list of what I consider the top five issues facing the industry.

Sign In to Your Account

Access Exclusive AsianInvestor Content!

Please sign in to your subscription to unlock full access to our premium AI resources.

Free Registration & 7-Day Trial

Register now to enjoy a 7-day free trial—no registration fees required. Click the link to get started.

Note: This free trial is a one-time offer.

¬ Haymarket Media Limited. All rights reserved.