ETF, multi-asset torrent tipped in Taiwan

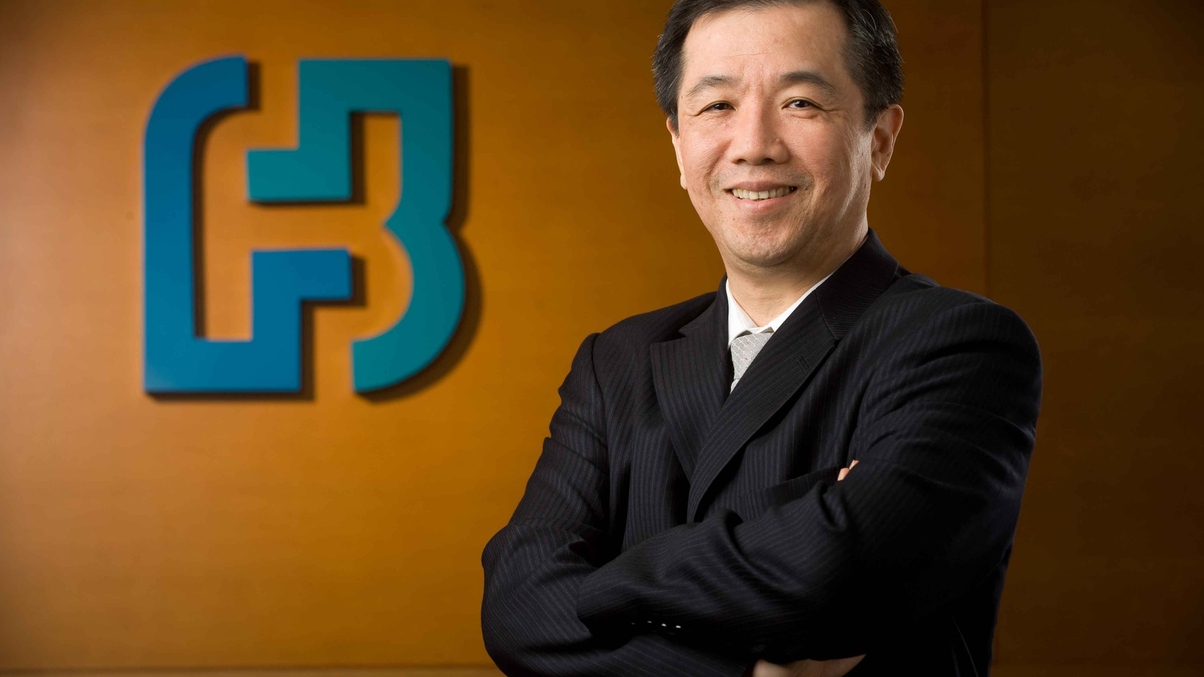

Henry Lin, president of Fubon Asset Management and Sitca chairman, expects some 20 ETFs and up to 30 multi-asset funds to be launched in Taiwan this year, including several by his firm.

Exchange-traded funds and multi-asset strategies look set to dominate product launches in Taiwan in 2016, with a focus on overseas markets such as China and Japan, said Henry Lin, president of Fubon Asset Management.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.