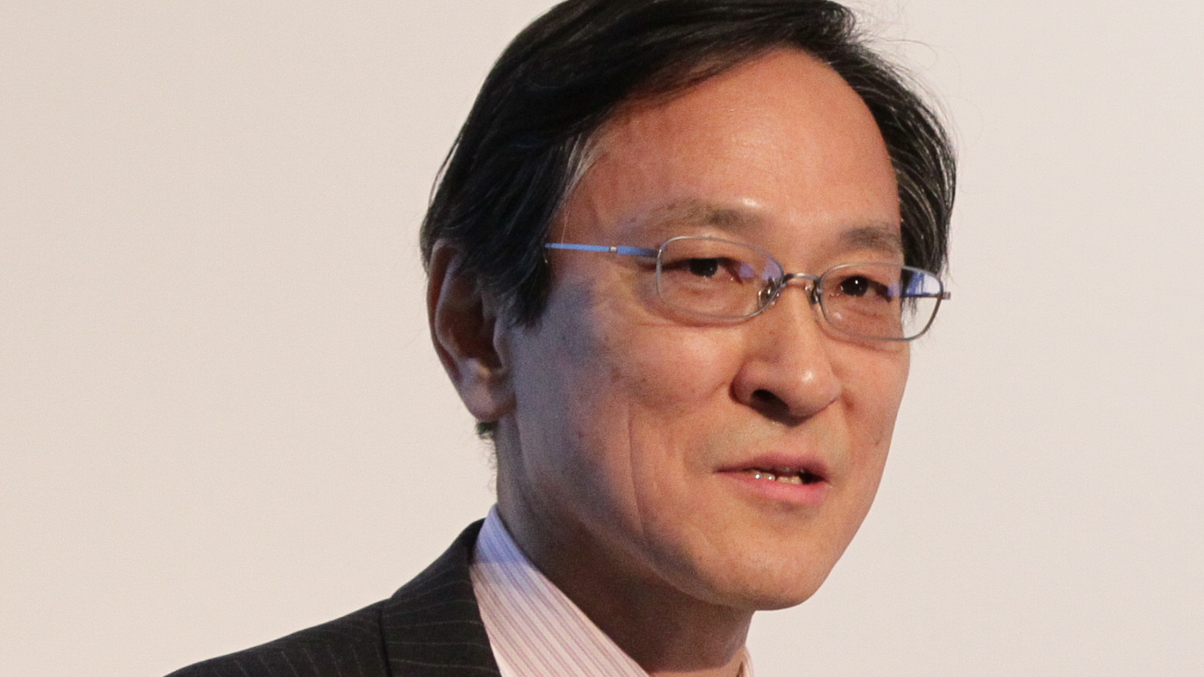

PFA's Hamaguchi sets out risk, alts strategy

Daisuke Hamaguchi, CIO at Japan's $106 billion Pension Fund Association, tells AsianInvestor how risk management has played a role in its asset allocation and what its alternatives plans are.

Japan’s Pension Fund Association (PFA) was set up in 1967 and came into being in its current guise in 2005.

Sign In to Your Account

Access Exclusive AsianInvestor Content!

Please sign in to your subscription to unlock full access to our premium AI resources.

Free Registration & 7-Day Trial

Register now to enjoy a 7-day free trial—no registration fees required. Click the link to get started.

Note: This free trial is a one-time offer.

¬ Haymarket Media Limited. All rights reserved.