EPF targets overseas equities, real estate

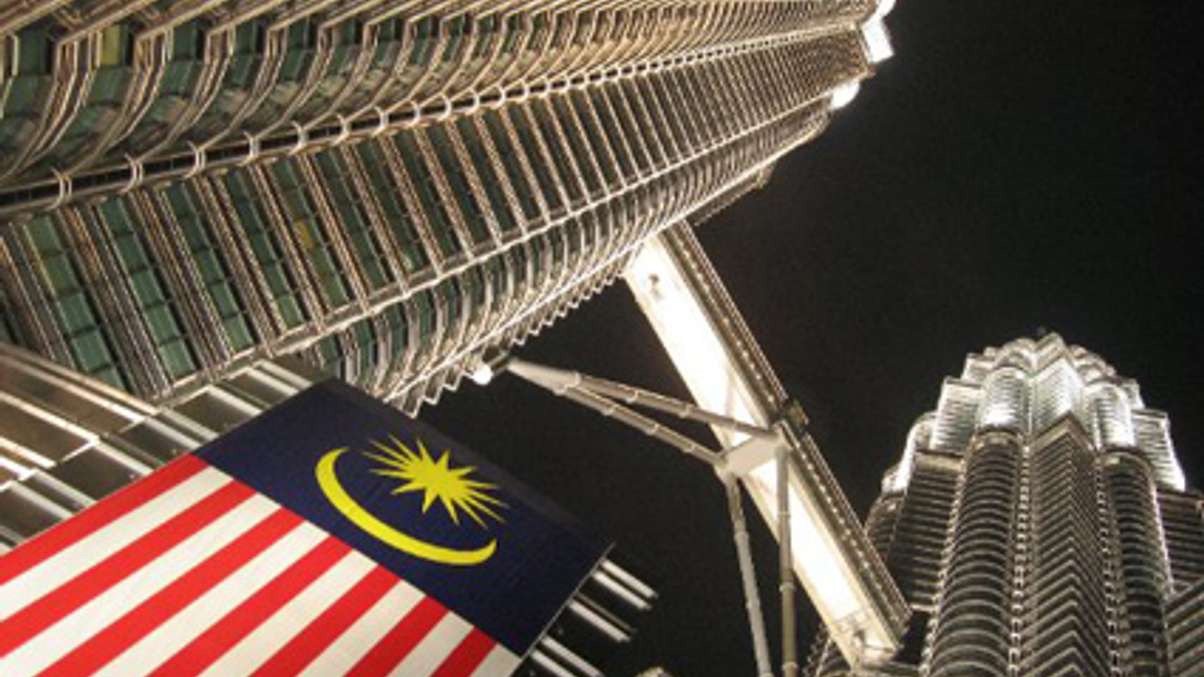

Malaysia's Employees Provident Fund is diversifying its investments globally and may reduce constraints on external managers.

Malaysia’s Employees Provident Fund (EPF) has announced plans to ramp up its overseas exposure to almost a fifth of total investments by the end of this year.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.