Banco do Brasil outlines key investor themes

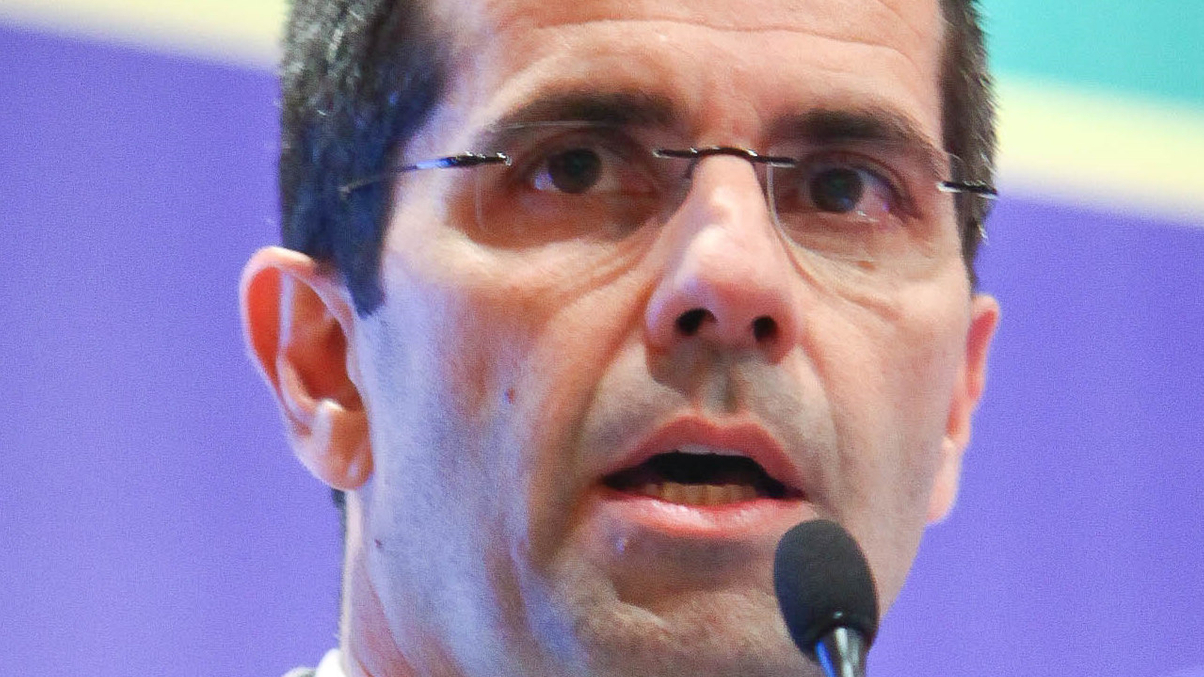

Strong domestic demand and infrastructure spending offer the best opportunities for international investors to capture Brazilian growth, says Carlos José da Costa André.

Surging domestic demand from a rising middle-class and huge planned infrastructure spending will provide key opportunities for investors to tap Brazilian growth, a conference was told.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to AsianInvestor

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

¬ Haymarket Media Limited. All rights reserved.