World’s wealthy tipped to target Asian trio

Three cities in Asia Pacific have been named among the world’s top 12 for future real estate investment as wealthy individuals are forecast to diversify from fully valued first-tier locales.

Melbourne, Jakarta and Chennai are among those tipped to show the strongest residential price growth as they become more fully invested, finds the Candy GPS Report*.

While London remains the world’s top city for overseas property investors, Deutsche Asset & Wealth Management – one of the report’s co-producers – sees clients turning to secondary locales as valuations in top-tier cities have climbed.

“Our ultra-high-net-worth (UHNW) clients are increasingly seeking locations outside the mainstream to broaden their real estate portfolios,” says Dario Schiraldi, head of the firm’s global client group.

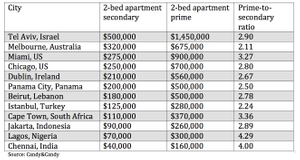

The report identifies 12 cities across Asia, Africa, the US, Europe and the Middle East that could record strong property price growth as investors search for targets that have yet to attract significant real estate investment (see graphic).

Yolande Barnes, director at report co-producer Savills World Research, notes that yield-hungry investors are starting to consider the value of second-tier cities in countries with strengthening economies. “Property rents and values will rise in line with new and growing economic strength,” says Barnes.

The report identifies characteristics other than economics that add to cities’ attractiveness, including English as a first or second language; the presence of new technology industries and financial centres; favourable conditions for international companies; and a large, young and well-educated population.

It concedes Melbourne is among the highest priced markets on its list, but argues it provides safe-haven status and will see more investment under Australia’s “Golden Visa” scheme – launched last year to allow wealthy foreigners a new type of visa provided they are prepared to invest in certain assets in Australia.

The research brands Chennai a fashionable enclave and a magnet to UHNWIs, and backs Jakarta on the back of a fast-growing economy – although it concedes lack of market transparency and quality housing stock may be a problem.

Asian investors

With UHNW investor numbers forecast to grow more quickly in Asia than other regions over the next five years, India, mainland China and Hong Kong are tipped to bolster their positions in the top-10 list of real estate investors.

Singapore-based Lynn Hermijanto, managing director of wealth management for Southeast Asia at Deutsche Asset & Wealth Management, has seen wealthy clients increasingly buying overseas property to diversify, including in London and Paris.

She notes, too, that investors have become more sophisticated, employing hedging strategies to limit exposure to currency and interest rate fluctuations.

At present, 48% of UHNWI real estate allocation by value goes to the world’s top 45 urban centres. London, Hong Kong, Moscow, Singapore and New York combined comprise 40%, or $2.2 trillion, of global UHNWI real estate holdings.

Hong Kong is world number one in terms of direct real estate holdings by value, at $798 billion, driven by Chinese investment and high property prices.

Germany is the world’s biggest source of UHNWI real estate investment with holdings of some US$945 billion, 18% of the global total. Japan is second with $621 billion (12%). In Asia, it’s followed by China ($379.7 billion) and India ($310.3 billion).

During two decades of deflation, overseas real estate had been seen as an attractive asset class in Japan. However, after the onset of Abenomics, Japan’s real estate market has gained momentum and seen price rises, the report says.

“People are looking for stable investments and real estate looks good from a total return perspective,” says Asoka Wöhrmann, Deutsche Asset & Wealth Management’s co-chief investment officer.

* The Candy GPS Report was produced by interior design house Candy & Candy, property research house Savills and Deutsche Asset & Wealth Management.